boulder co sales tax return form

Ad The Leading Online Publisher of Colorado-specific Legal Documents. Mail return with check made to City of Brighton via certified or express delivery.

City Of Delta Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

This form is provided by home rule municipalities within the State of Colorado to record supporting information for any transaction on which an exemption from tax is claimed.

. Is Colorado Springs a home rule city. CERTIFIED OR EXPRESS DELIVERY 500. The Assessors Office calculates the amount of those taxes.

City of Boulder Food Tax Rebate Application for Rebate of Taxes from 2021 1 CITY OF BOULDER. Form Instructions In preparing. Ad Have you expanded beyond marketplace selling.

Ad CO Sales Tax Return More. The 80524 Fort Collins Colorado general sales tax rate is 755. In 2001 the voters of Boulder County passed a ballot issue that allowed for a 01 percent one cent on a 10 purchase countywide transportation sales tax.

What is the sales tax rate in Boulder Colorado. Ad Have you expanded beyond marketplace selling. PdfFiller allows users to edit sign fill and share all type of documents online.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Boulder CO. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The Treasurers Office collects taxes for real property mobile homes and business personal property.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. DR 0100 - Retail Sales Tax Return. File Sales Tax Online.

Use tax is levied in the following circumstances. Get Access to the Largest Online Library of Legal Forms for Any State. The City of Colorado Springs is a home rule city and is authorized to levy and collect its own sales tax.

DR 1369 - Colorado State. 2020-2021 Filing Periods Supplemental Instructions. SALES TAX RETURN FILING INSTRUCTIONS RETURN WITH PAYMENT - STANDARD MAIL City of Brighton PO Box 913297 Denver CO 80291-3297.

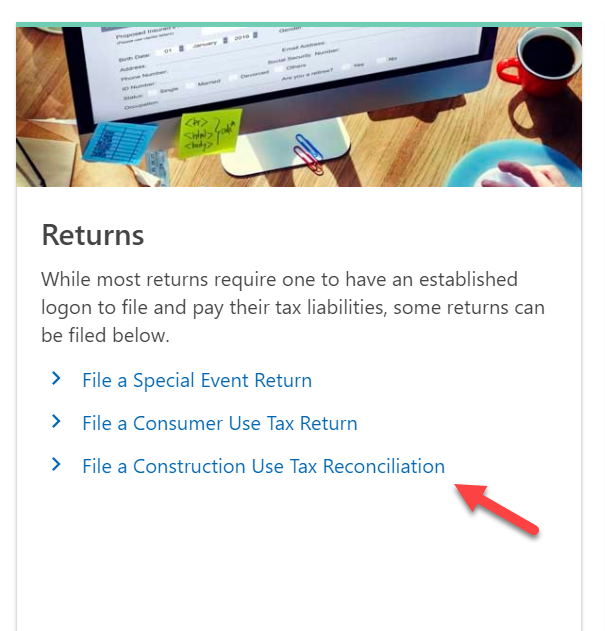

500 S 4 th Ave. Prepare and file your sales tax with ease with a solution built just for you. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and.

Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales. Integrate Vertex seamlessly to the systems you already use.

Reconciliation is a process of filing a construction use tax return upon completion of a permitted construction project to determine whether there was an overpayment or underpayment of. Brighton CO 80291. The libraries below will only carry Forms 1040 except CU which carries 1099 and 1096 forms as well.

In 2007 voters approved an. People also ask co sales tax return boulder form. Prepare and file your sales tax with ease with a solution built just for you.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The minimum combined 2022 sales tax rate for Boulder Colorado is. How 2019 Sales taxes are calculated for zip code 80524.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. From the 2021 Federal 1040 tax form or total income from all sources if you. Storing using or consuming in.

After you create your own User ID and Password for the income tax account you may file a return. Sales Tax Return DR 0100 092721 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 TaxColoradogov DONOTSEND General Information. About City of Boulders Sales and Use Tax.

This is the total of state county and city sales tax rates. Filing frequency is determined by the amount of sales tax collected monthly. Our tax preparers will ensure that your tax returns are complete accurate and on time.

Avalara can help your business. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Denver CO 80291.

If you need additional assistance. DR 0098 100719 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 ColoradogovTax DONOTSEND Form Instructions In preparing a special event sales tax. What is sales tax in Fort Collins CO.

Sales tax returns may be filed annually. Prior Year Sales Tax Forms. Avalara can help your business.

Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. PdfFiller allows users to edit sign fill and share all type of documents online. Annual returns are due January 20.

BOULDER COUNTY USE TAX For 2020 Boulder County collects use tax at the rate of 0985. Navigating the Boulder Online Tax System. The combined rate used in this.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. University of ColoradoNorlin Library Government Information Library - Staffed. 15 or less per month.

There are a few ways to e-file sales tax returns. - Special Event Sales Tax Return.

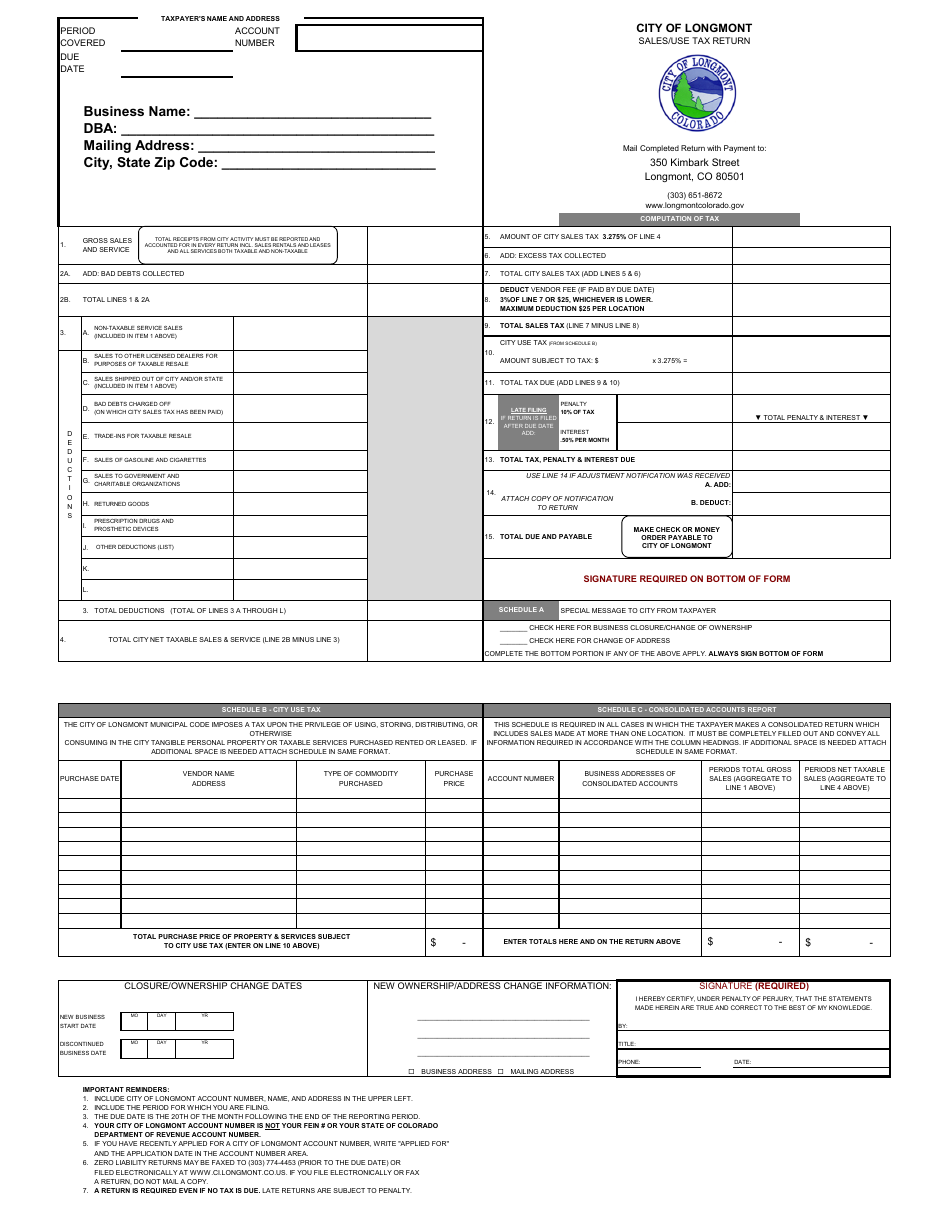

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Construction Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder